November Auto Sales Falls amid Production Halt and Chip shortage:

- Despite of festivities auto companies could not generate most of their yearly sales in this month.

- Chip shortage is being taken on supply front but still it has not met the demand and this has resulted in poor sales performance of passenger vehicles. On the contrary commercials has bucked the trend and it has rebound from its last year’s volume and the same has been observed in 2 Wheeler industry as well.

Robust demand seen from rural area as it comes out of lockdown early and this has resulted in strong growth in 2 wheeler and tractor sales. - Global semiconductor crisis impacted and in some cases halted the production of passenger Vehicles and this has resulted in delay in launch of new variants from OEMs.

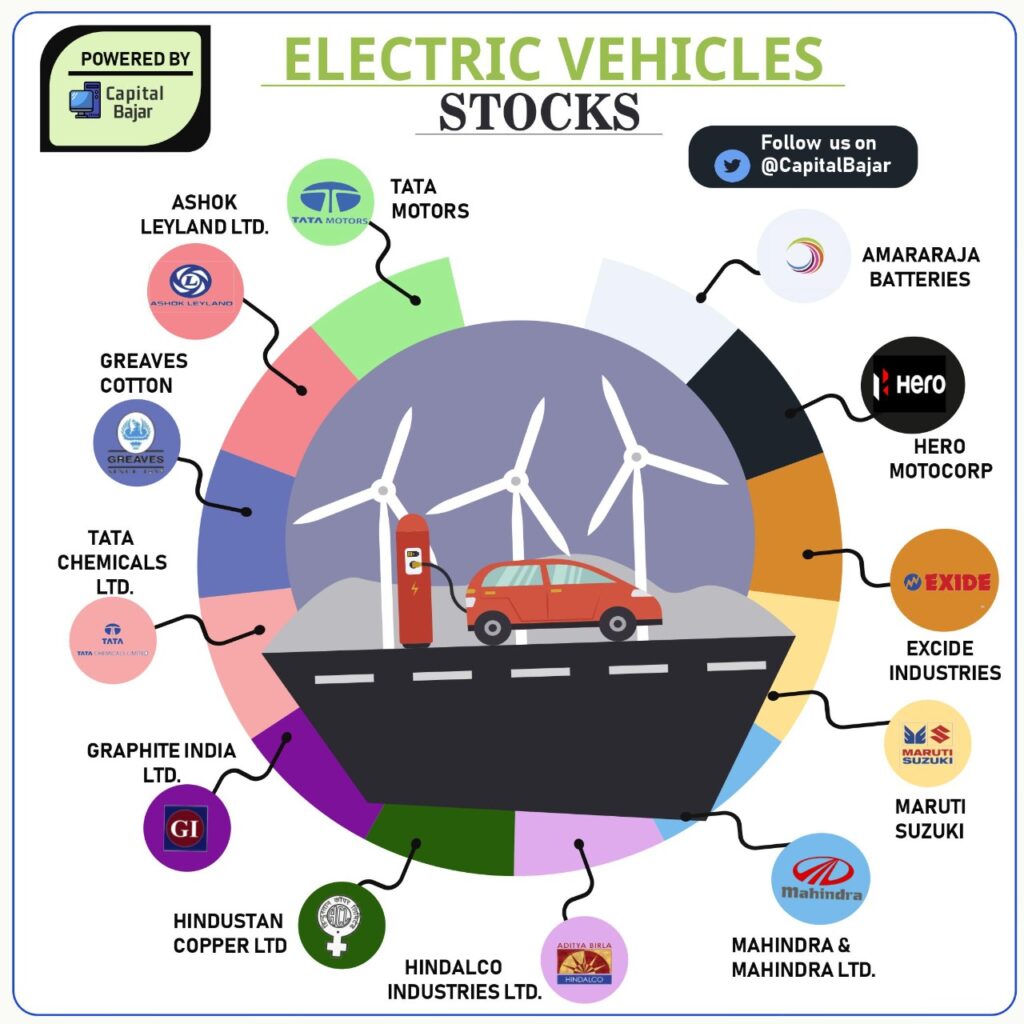

On positive note, Electric Vehicle industry has grown in pandemic phase due to rise in cost of fuels and early investments commitments by OEMs like TATA and Mahindra. Like many governments in the world are pushing up for the electric vehicles to reduce the emissions and their dependence on the imports from other countries. - Furthermore, to meet the rising cost many of the OEM’s have increased their prices and this has put further dent on the demand and shying off the consumers away.

- On the other side of coin M&HCVs (medium and heavy commercial vehicles) witness rise in demand and it has been met as well, thanks to last year’s low base effect. LCV Light Commercial Vehicle however had witness low sales volume with high base effect in consideration.

Segment wise Analysis:

Let’s take a look at the segment wise and sectoral performance of the automobile industry during November 2021.

Passenger Vehicles:

- Chip shortage, production halt has resulted in year on year drop of 12.5 percent, however on export side it has seen a very robust growth of 127.4 percent on gaining demand at overseas.

- Tata Motors the limelight of dalal street has recorded 38% percent rise in sales volume and in this (EV) electric vehicle grew by 324% percent which has set a unique example amongst the OEMs . in November. But traditional ICE (internal combustion engines) vehicle also recorded rise in sales by 32 percent.

- Maruti Suzuki one of the biggest vehicle passenger vehicle manufacturer in India and also number one in market share has taken a jolt due to production cuts. It has lost a total volume of 1,39,184 units compared with previous year.

- Chip shortage spoiled the show which has resulted in shutdown at its plant frequently. However, light has been seen at the end of the tunnel as company is expecting the improvement in the situation and have decided for a ramp up in its production targets.

- Mahindra & Mahindra (M&M) also has faced similar situations and have undergone through shutdowns and production cuts – volumes have declined including UVs and pick-ups – declined 4 percent YoY and 2 percent MoM. However its Thar and newly launched XUV-700 has witness robust demand and has robust booking .

Two-Wheelers:

Two wheeler makers have seen decline in their sales volume with a range of 30 to 40 percent majorly due to subsued demand from rural areas due to uneven rainfall and delay in harvest of khariff crops. TVS, Bajaj Auto, Hero Moto Corp and Royal Enfield all have registered YoY decline .

But exports have seen robust growth specially for the TVS motors while that of Bajaj Auto were flat due to high base effect of last year.

All of the above, commodity prices and high petrol prices are further downgrading the demand.

Next month that is December is a seasonally week and present momentum will further slow demand for two wheelers. Also high number of players and also increase in the number of new entrants in electric vehicle manufacturers resulting reduction of shares for bigger OEM’s .

Commercial Vehicles:

Commercial Vehicle players like TATA Motors and Volvo Eicher are also felling the heat of low demand. Supply chain constraints are adding further problems for increasing volume.

In the MHCV (mid and heavy commercial vehicles) segment, Tata Motors recorded rise of 10 percent volumes while its nearest Ashok Leyland witnesses 2 percent decline in volumes Overall, the MHCV volumes were 30-50 percent below March 2021 levels.

Bus manufacturing and take up are in line with the recovery witnessing after pandemic and are close to half of its normal level

Tractors:

Tractor which is major driver for checking of rural area business activity has also suffered due to delay in harvesting and natural calamity like floods in some areas.

Mahindra and Escorts have witnessed decline of 17 percent and 43 percent in sales respectively.

Projection:

“We at Capital Bajar are continuing to remain positive on the automotive sector despite of Omicron and other factors like chip shortage etc. We are seeing that people are preferring 2W and 4W as transport due for their personal safety from virus.

“In the Passenger Vehicle segment, normalisation of chip shortage will quickly improve the production at plant levels and thus will increase in sales of auto motives,” said JM Financial in its report.

The healthy agro pricing, robust khariff harvest will further support demand for the tractors expected by the brokerage house. Furthermore, continued strong support by government to all agro activities will enhance confidence in the rural consumers.

On the note side , Reserve Bank of India is also seems to be not in a mood of increase in interest rates and continuing its support of recovery after pandemic .