The Union Budget 2026 was announced in the last few days, shaping the direction of India’s economy, taxation and investment. Every year, we pay attention to the budget announcements to understand the impact on individuals, businesses and investors.

This annual budget promotes economic stability, long-term growth, and strengthens key sectors such as infrastructure, healthcare, manufacturing, and digital development. For the common man and investors, this budget provides clarity on income tax changes, savings, investment opportunities, and market outlook.

This blog by Capital Bazaar explains the highlights of Budget 2026, its impact on the economy, middle-class households and investors – and what you should do next to align your financial planning with the latest budget announcements.

What is Union Budget 2026?

The Union Budget is the annual financial statement presented by the Government of India, which outlines the estimated revenue and expenditure for the upcoming financial year.

The Union Budget 2026 was presented by the Union Finance Minister on February 1, 2026. This budget provides a framework for economic growth, policy priorities, and fiscal reforms.

Union Budget 2026: Understand the Key Features

Here are some of the key features of the 2026 budget:

- Strong emphasis on infrastructure and capital expenditure

- Continued investment in healthcare and digital services

- Support for Micro, Small and Medium Enterprises (MSMEs) and startups

- Measures to control inflation

- Incentives for long-term investment and savings

This will enable a balance between fiscal discipline, economic stability, and development.

What are the income tax changes in Budget 2026?

Every year, the income tax announcements are very important for taxpayers. This year, the income tax changes in Budget 2026 focus on simplification, ease of compliance, and stability, rather than making major changes. Although there are limited changes in the restructuring of the main tax slabs, this budget encourages long-term savings and financial planning. This directly impacts the following:

- Budget 2026 Tax Slabs

- Salaried Employees

- Tax planning strategies for the middle class

How will the 2026 budget affect the middle class and the common man?

The 2026 budget for the middle class aims to combat rising inflation and improve financial security.

The key focus areas are:

- Inflation control

- Family savings

- Affordable access to healthcare and education

For the common man, this budget supports long-term stability rather than providing immediate relief.

The Impact of the Budget on the Indian Economy

Due to the government’s substantial spending on infrastructure and growth-focused sectors, the impact of the budget on the economy is largely positive. This will:

- Improve employment opportunities

- Strengthen domestic production

- Support economic recovery and growth

A stable macroeconomic framework boosts investor confidence and market sentiment.

The impact of the 2026 budget on the stock market

We can observe the impact of the budget on the stock market in two phases:

- Short-term volatility at the time of announcements

- Long-term growth based on sectoral policies

Sectors such as infrastructure, healthcare, manufacturing, and capital goods can benefit significantly from growth-oriented budgets.

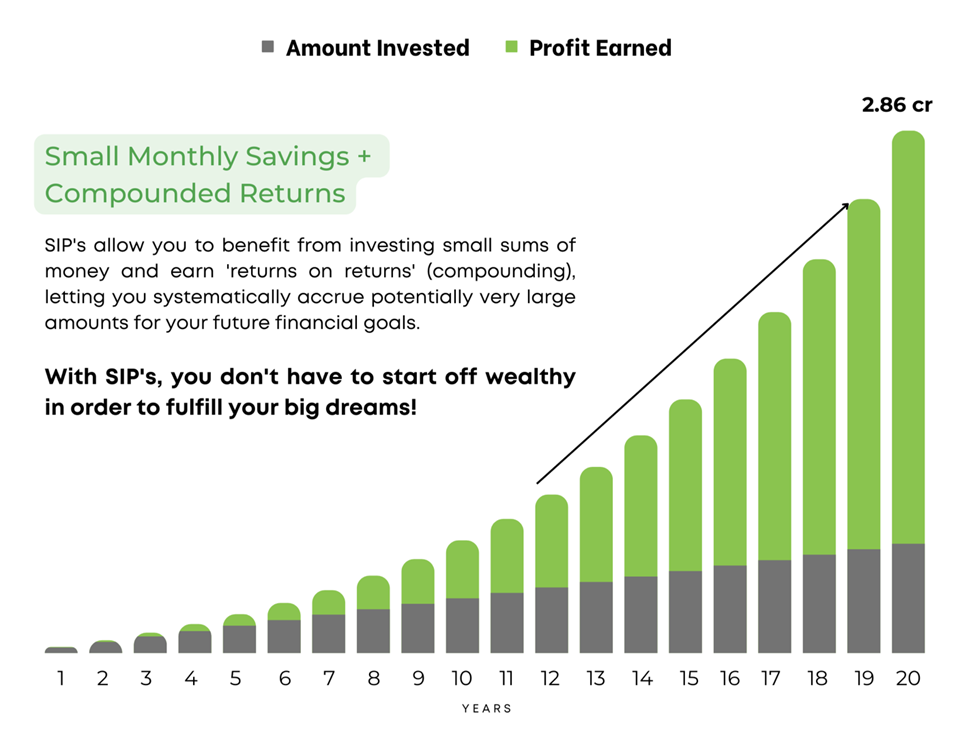

Impact of the Budget on Mutual Funds, SIPs, and Long-Term Investments

The budget has shown a very positive impact on mutual funds and SIP investments for disciplined investors.

- SIPs are one of the most effective tools for long-term wealth creation.

- Economic growth benefits market-linked investments.

- Budgetary stability supports consistent investment behavior.

Long-term investors are advised to stay invested and avoid reacting to short-term fluctuations.

Budgetary impact on insurance, gold, and bonds

This budget has clarified the importance of insurance, prioritizing the financial security of the family.

- Insurance strengthens risk management.

- Gold and bonds provide portfolio stability.

- Diversification remains essential.

These instruments help mitigate risk during market fluctuations.

Best Investment Opportunities After the 2026 Budget

After the budget, investors should think long-term and look for investment opportunities beyond 2026.

Key principles to follow:

- Maintain diversification in investments

- Align investments with financial goals

- Avoid making emotional decisions

Building wealth after the budget depends more on consistency than on reacting to announcements.

What should investors do after the 2026 budget?

- Review your financial goals

- Continue SIPs and long-term investments

- Avoid panic buying or selling

- Seek expert guidance as needed

Post-budget financial planning should focus on long-term security and growth.

Frequently Asked Questions: Union Budget 2026

Is Budget 2026 good for investors?

Yes, it promotes long-term economic growth, and disciplined investors will benefit.

Which sectors will benefit most from Budget 2026?

Infrastructure, manufacturing, healthcare, and the digital sector show significant potential.

Should I change my investments after Budget 2026?

In most cases, no. Maintaining your investments is usually more beneficial than making frequent changes.

How does Budget 2026 affect personal finances?

It impacts taxes, savings, investments, and inflation—making financial planning essential.

Capitalmarket’s Perspective on the 2026 Budget

The 2026 Union Budget serves as a guide for long-term stability and growth. Investors and the middle class should make informed, consistent, and long-term decisions without haste.

At Capitalmarket, we believe that informed decisions and disciplined planning are the foundation of sustainable wealth creation.